Content

- Introducing earn By Cake Defi

- Defi Liquidity Mining: Everything You Need To Know About

- Liquidity Mining: Key Terms And Concepts

- What Is Defi?

- Are There Any Taxes On Liquidity Mining Switzerland

- What Are The Advantages And Disadvantages Of Liquidity Mining?

- Can Ethereum Be Mined On Phone?

- Can You Lose Money In Liquidity Mining?

It is not necessary that the platform only accommodates cryptocurrency trading. The same is applicable to an investment in crypto startups or lending. But most often, this approach is popular among automated market makers .

Simply go to our Liquidity Mining page and choose from the wide variety of liquidity mining pools available. We’ve included details such as APR, Primary Token Price and Total Liquidity for transparency and which should prove to be useful when deciding on which Liquidity Mining pool to deposit crypto pairs in. However, funds are still deposited into a pool that serves as a temporary custodian in DEXes’ liquidity pool model despite its protection from counterparty and custodial risk.

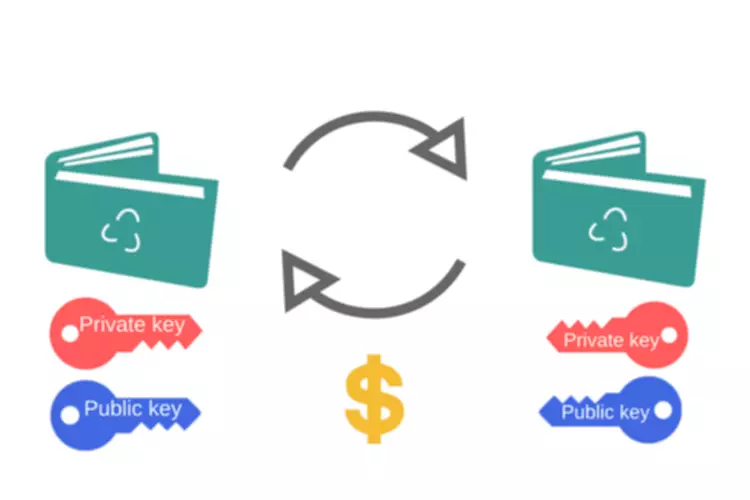

The yield farmers lend their tokens to the liquidity pools which are basically decentralized applications having smart contracts. When the participants lock their tokens in the pool, they get a fee from the decentralized finance platform supporting the liquidity pool. The liquidity pools in turn support marketplaces where people borrow or lend money and pay a fee for the services. This fee helps in rewarding the liquidity providers or yield farmers for lending their tokens. Crypto holders lend assets to a decentralized exchange in return for rewards through liquidity mining.

Introducing earn By Cake Defi

It is a process by which blockchain assets are exchanged for other assets or tokens. It’s essentially an automated way of increasing the liquidity of your holdings, and What Is Liquidity Mining it can be used to protect you from traditional counterparty and custodial risk. The logical consequence is that the Fees divided among more liquidity providers become.

- These loans sometimes result in a considerable return for yield farmers.

- ” by this point, other passive investment strategies likestaking and yield farmingalso have notable advantages.

- Professional investors always distribute their holdings in various pools and vaults to minimize the risks.

- According to my Liquidity Mining experience, this small loss is compensated by the returns.

- Over the next three years, the concept was further refined bySynthetixandCompound.

There are more options for yield farmers in SushiSwap that Onsen pools are among the most attractive ones. The DeFi protocols also allow users who hold DeFi tokens access to discounted trading fees and other benefits across all of the participating platforms. Liquidity pools provide you with the ability to lock your assets in the form of tokens when liquidity mining with a decentralized exchange . These assets can then be traded by individuals on the platform without involving a go-between. You can receive native tokens once you provide liquidity to a liquidity pool. Before the emergence of decentralized finance and DeFi platforms, users could only access liquidity by exchanging some assets for others.

With liquidity mining, the benefits don’t end with the income that you receive as a liquidity provider. By continuing to engage with the protocol, you’ll continue to receive additional benefits. They operate like traditional exchanges, but are not affected by their weaknesses, such as lengthy transactions, high gas fees and slippage. When traders lock their assets in a smart contract, a liquidity pool gets created.

Here, you want to see how many developers contribute to the project, the frequency and their identity. AMM – AMMs are smart contracts designed to hold the liquidity reserves within a pool. It is the AMMs to which the LPs deposit their assets and traders interact to exchange their crypto.

Defi Liquidity Mining: Everything You Need To Know About

If the exchange supports OTC trading, then the liquidity provider here is either the exchange itself or other institutional investors. Passive income – liquidity mining is an excellent means of earning passive income for the LPs, similar to how passive stakeholders within staking networks. The more an LP contributes towards a liquidity pool, the larger the share of the rewards they will receive. Different platforms have varying implementations, but this is the basic idea behind liquidity mining.

If the rewards for a solved block are very large, the return is also larger. Actual Rewards depend on the amount staked as well as the size & amount of bridgings that will happen in the future. The higher both, the higher the collected protocol incentive or bridging fees and the higher the rewards. Wrapped tokens are assets that represent a tokenized version of another crypto asset.

In addition to rewards, miners also receive fees from any transactions contained in that block of transactions. If a liquidity provider puts liquidity in a Liquidity Pool, the liquidity provider has up to two earn options for the received LP Tokens. Earn Option 1 is putting the LP Tokens in the corresponding Liquidity Mining Pool. For all liquidity providers of tokens that also have https://xcritical.com/ a Farm, there’s an Earn Option 2 to put the LP tokens in a more attractive Farm. The main benefit of investing in liquidity mining is that your yield is proportional to the risk you take, which allows you to be as risky or as safe with your investment as you’d like. This particular investment strategy is also very easy to get started with, which makes it ideal for beginners.

Liquidity Mining: Key Terms And Concepts

His reports were cited by many influential outlets globally like Forbes, Financial Times, CNBC, Bloomberg, Business Insider, Nasdaq.com, Investing.com, Reuters, among others. Gain smart DeFi access with interoperability across multiple blockchain ecosystems. EGG Protocol integrates with DeFi from Ethereum, Polkadot, Binance Smart Chain, Solana, Cardano and Tron.

Decentralized finance is a new fintech application that seeks to disrupt traditional financial markets using decentralized networks such as blockchains. DeFi platforms work by eliminating centralized financial intermediaries allowing market participants to interact in a peer-to-peer manner. So while there are benefits to liquidity mining, it’s important to be aware of all the risks before jumping into this type of investment. We want to help you understand what liquidity mining is, usdt liquidity mining plus we will discuss what its risks are and whether it is worth investing in.

Since your investment is essentially used to facilitate decentralized transactions, your rewards usually come in the form of trading fees that accrue whenever trades occur on the exchange in question. Since your share of the liquidity pool dictates what your yields are, you can essentially estimate what your rewards will be before you’ve even invested. The win-win-win outcome in liquidity protocols – all parties within a DeFi marketplace benefit from this interaction model.

Or you can't do anything with it and wonder, what should be a temporary loss at all. Liquidity pairs, which are rather unknown, have fewer participants. Ergo, the return increases because it is divided among fewer participants.

What Is Defi?

WhenDeFiliquidity mining was first introduced by IDEX, it existed in the form of a reward program which provided certain benefits to participants on the exchange. Instead of locking capital in a separate pool, participants were given IDEX tokens once they made the decision to provide liquidity. In order to obtain IDEX, the only thing participants had to do was fill a basic limit order.

Once you convert your assets into LP tokens and deposit them into the liquidity pool, you are not able to trade them during the liquidity mining period. You will have to withdraw your LP tokens first then exchange them for the desired assets and after that you will be able to trade your assets without any limitation. A staking pool is the group where validators come together with their resources and participate in the pool to maximize their chances of validating the new blocks and earning rewards in return. When they receive rewards, they are proportionally shared among the validators based on their initial contributions.

Liquidity mining is a decentralized finance mechanism wherein participants provide some of their crypto assets into various liquidity pools, from which they’re rewarded with tokens and fees. In recent years, the use of blockchain and cryptocurrency has grown rapidly. While the main investing strategy for crypto is to purchase and hold cryptocurrencies until they increase in value, there are several additional methods you can use to earn passive income. One such strategy involves liquidity mining, which takes advantage of the immense hype behind decentralized finance while allowing investors to use their holdings to generate additional income. This is called an impermanent loss since it can only be realized if the miner decides to withdraw the tokens with depressed prices. Sometimes this unrealized loss can be offset by the gains from the LP rewards; however, crypto assets are highly volatile with wild price movements.

Are There Any Taxes On Liquidity Mining Switzerland

Vote on crucial changes to the protocols, such as fee share ratio and user experience, among others. Binance CEO Changpeng Zhao , runs the world’s largest crypto exchange. He is a billionaire, valued at $1.9 billion, ranked number 5 on Forbes’ Crypto Rich List, and one of the most followed and influential members of the industry. Mehdi is a content writer with great experience in the blockchain sector, in addition to writing breaking news, he is also in charge of making guides, tutorials and reviews of the different projects. The most transparent way to get cashflow from your cryptocurrencies. Similar to other DeFi products and services, Liquidity Mining has a relatively low barrier to entry.

Crypto scammers are fighting amongst themselves over stolen funds - TechRadar

Crypto scammers are fighting amongst themselves over stolen funds.

Posted: Wed, 05 Oct 2022 20:52:32 GMT [source]

For example, if the plan is to open large short positions and turn the market around. In this way, you can manipulate the market, make profits by betting on the fall of rates, and raise revenue through commissions. But this is a dirty game, and legal platforms do not normally resort to this.

A token issuer or exchange can reward a pool of miners to provide liquidity for a specified token. For example, on the Compound protocol, users who deposit tokens will earn both interest and a share of the Compound governance token, COMP. In terms of objectives, yield farming aims to offer you the highest possible returns on the crypto assets of users. On the other hand, liquidity mining focuses on improving liquidity of a DeFi protocol. Furthermore, staking emphasizes maintaining the security of a blockchain network. Compound was the first platform to introduce yield farming to users.

What Are The Advantages And Disadvantages Of Liquidity Mining?

If the tokens have a lower price when you decide to withdraw than they had when you first placed them into liquidity pools, you lose money. You can offset this particular risk with the gains you obtain from trading fees. However, the volatility of the cryptocurrency market means that you should be at least somewhat cautious when depositing your money into DEXs. Before you start investing your crypto assets in liquidity pools, you should know whatimpermanent lossis and how it can affect you. This can occur when the price of the tokens that you’ve contributed to liquidity pools changes in comparison to what it was when you first invested. A more substantial price difference makes it more likely that you’ll encounter an impermanent loss.

The DeFi liquidity mining concept was adopted at an exceedingly fast rate once Compound announced it in 2020. Since then, the total value locked in regard to liquidity mining is at just under $97 billion. One major reason for its popularity among exchange participants is that anyone can use this strategy.

Established liquidity pools can have approximately $1 million invested in them, making them relatively stable for novice crypto traders. Smaller pools are more vulnerable to market swings, which might result in a drop in the value of your tokens. For example, the malicious liquidity provider mints a token on Uniswap, SushiSwao, etc.

Can You Lose Money In Liquidity Mining?

You can’t always know what’s in the code of a smart contract and what the outcome may be. When you exchange currency with a bank, you buy and sell it to that bank. Hence, such high spreads are determined by the organization itself. However, the use of the term mining in this title alludes to the idea that these liquidity providers are looking for some rewards – fees and/or tokens – for their efforts. If the block of assembled transactions is accepted and verified by other miners, then the miner receives a block reward. Another incentive for bitcoin miners to participate in the process is transaction fees.

Depending on the platform’s operating principle, liquidity is provided by traders or organizations – banks or exchanges. On crypto exchanges, they are usually the users themselves, who place orders to buy and sell. In other words, trading on crypto exchanges is person-to-person or P2P trading. You may have heard of it – Binance has a separate section for P2P trading.